Real-Time, Automated Network Cost Intelligence

Service providers, content platforms, and digital enterprises are under constant pressure to scale their networks while controlling costs and driving revenue. Yet understanding connectivity spend across hundreds or thousands of network interfaces, and what underlying traffic is driving those costs, has remained one of the industry’s most complex challenges.

Kentik is the only platform that solves this problem at scale. With our Connectivity Costs and Traffic Costs automated workflows, we unify traditionally siloed data sources to deliver real-time network cost intelligence – track connectivity spend across all providers, instantly calculate the cost of key traffic slices, and see exactly how traffic is driving spend across your network.

Network cost intelligence is the practice of linking network traffic, paths, and contracts or cloud pricing so network teams can explain what traffic is driving spend, forecast costs, and optimize provider mix, routing, and interconnect capacity.

Optimize spend and increase revenue

Confidently price services, negotiate contracts, and engineer traffic paths to reduce spend, boost performance, and increase profitability.

Eliminate complexity

Automate network cost analysis with instant insights. Free engineering teams from manual spreadsheets and fragmented tooling.

Accelerate decision making

Empower sales, finance, and executive teams with real-time network cost insights to make faster, smarter, data-driven decisions.

“Kentik Traffic Costs is like putting our connectivity spend under an X-ray. We now have instant visibility into which portions of our traffic are driving costs – and exactly where to optimize for performance and savings.”

– Tomás Lynch, Senior Network ArchitectUse Kentik’s network cost intelligence capabilities to:

Identify high-cost paths: Surface routes and interconnects driving the most spend and take action to optimize traffic engineering and interconnect agreements.

Improve margins: Compare per-customer and per-service traffic costs against revenue to guide smarter pricing, renewals, and negotiations.

Eliminate manual toil: Replace hours of spreadsheets with automated insights, freeing engineering teams for higher-impact work.

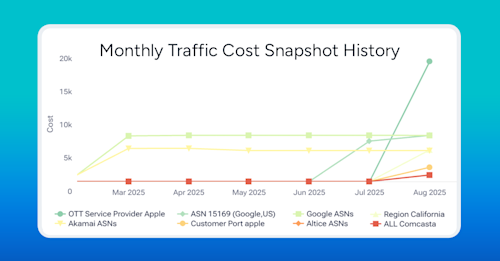

Track trends over time: Measure the financial impact of peering or routing changes and share results across teams.

Democratize cost insights: Give finance, sales, and leadership real-time access to cost drivers for data-backed decision making.

Forecast and validate spend: Eliminate billing surprises with automatic forecasts and contract validation.

How Kentik delivers network cost intelligence

-

Ingest pricing, utilization, and traffic context. Capture provider pricing and contract terms, collect SNMP-based interface utilization, and ingest flow data that identifies what traffic is and where it goes (Connectivity Costs KB, Traffic Costs KB).

-

Normalize complex billing models. Translate 95th percentile, flat-rate, tiered, and commit-based structures into consistent cost models so you can compare spend across providers, sites, markets, and connectivity types (Connectivity Costs KB).

-

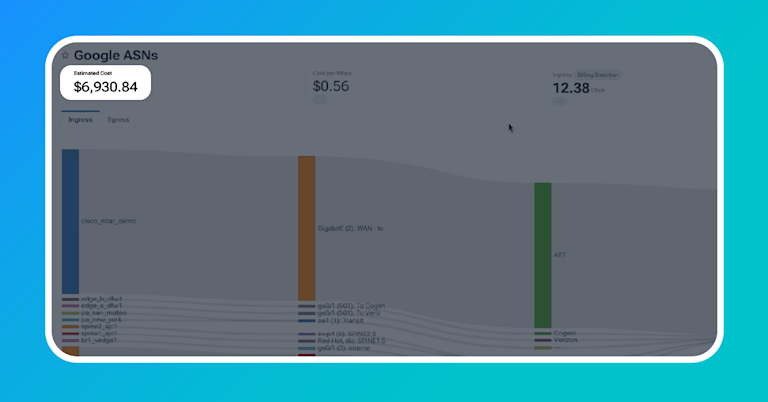

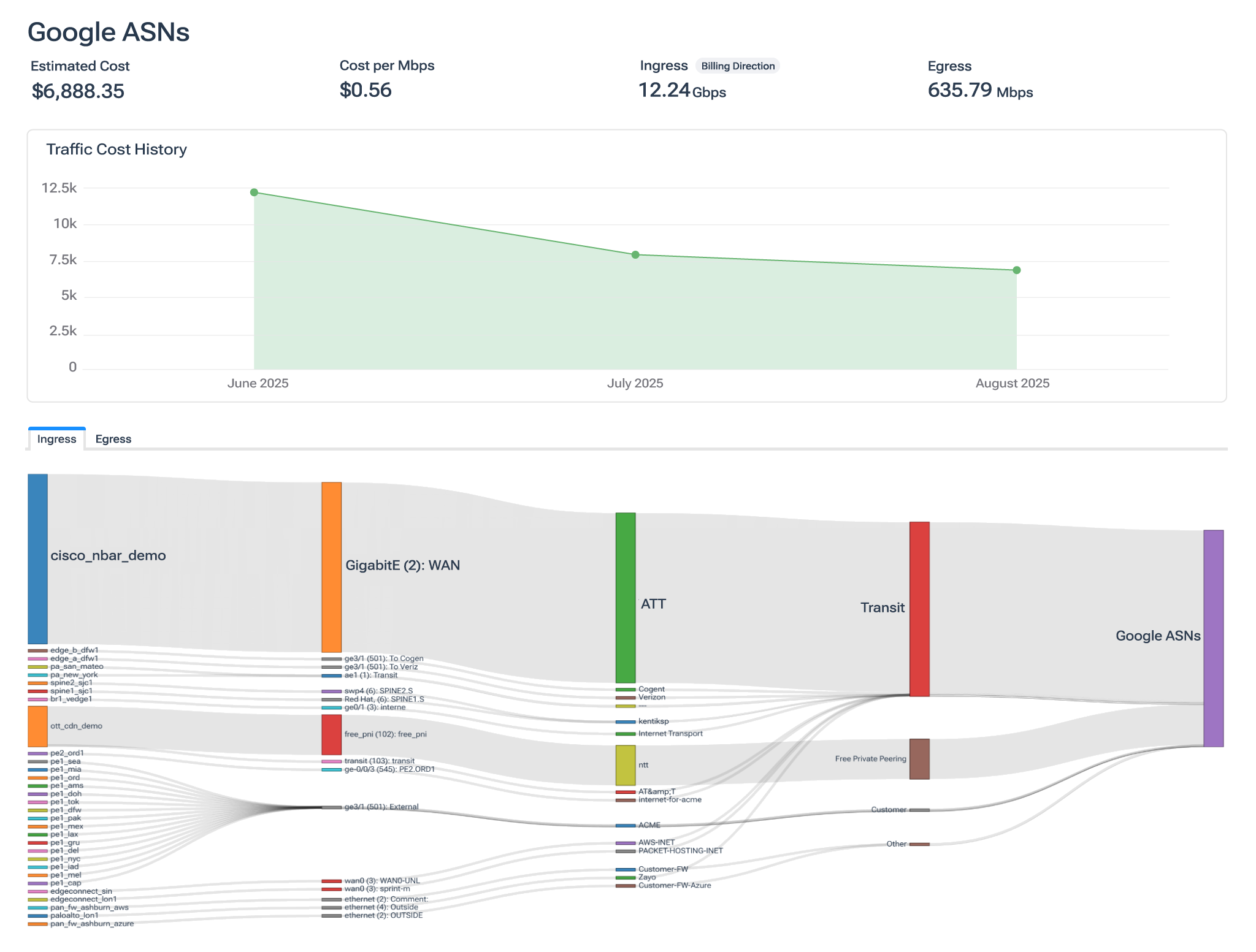

Attribute spend to traffic slices. Apply connectivity pricing to flow-enriched slices such as ASN/AS group, customer ports, CDN/OTT, geography, and IP/CIDR so you can estimate total monthly cost and effective cost per Mbps for each slice (Traffic Costs KB, Introducing Traffic Costs).

-

Optimize high-cost paths and provider mix. Surface high-cost routes and interconnects, evaluate peering opportunities, and make smarter commit and contract decisions using unit economics and traffic trends (Introducing Traffic Costs, Peering & Interconnection).

-

Prove outcomes over time. Validate invoices, forecast costs, and use snapshots plus monthly tracking to quantify the impact of routing and peering changes with a defensible historical record (Connectivity Costs KB, Traffic Costs KB).

Executive outcomes

-

Spend transparency: Understand projected connectivity spend and unit cost, broken down by provider, connectivity type, site, and market (Connectivity Costs KB).

-

Forecast + invoice validation: True-up provider invoices, uncover billing errors, and forecast connectivity costs based on current-cycle traffic (Connectivity Costs KB).

-

Margin decisions: See what specific customers, regions, and traffic slices cost to deliver so teams can compare delivery cost against revenue when pricing services and negotiating renewals (Traffic Costs press release).

-

Savings you can defend: Track before/after cost changes from traffic engineering and peering shifts with snapshot-based trending and monthly history (Traffic Costs KB).

Kentik complements FinOps

FinOps practices are great at governing cloud spend and explaining invoices. Network cost intelligence answers a different question: “Which traffic paths and interconnect decisions are driving that spend, and what should change?”

- FinOps tools: focus on cloud billing, allocations, and governance.

- Kentik: links contract models and SNMP utilization with flow context to attribute connectivity spend to traffic slices and routes, so teams can optimize provider mix, peering, and routing decisions (Connectivity Costs KB, Traffic Costs KB).

FAQs about Network Cost Intelligence

What is network cost intelligence?

Network cost intelligence links connectivity contracts and billing models with traffic and utilization so teams can explain what’s driving spend, forecast costs, and optimize provider mix and traffic engineering. Kentik supports this by combining the Connectivity Costs module (provider pricing models + SNMP-based traffic volume) with the Traffic Costs workflow (flow-based cost estimates for traffic slices) to connect spend to the traffic that caused it (Connectivity Costs KB, Traffic Costs KB).

What data do I need to calculate traffic costs accurately in Kentik?

To estimate traffic costs accurately, you need contract/rate information, interface traffic volume (typically via SNMP), and flow data that identifies what the traffic is and where it’s going. Kentik supports this by using Connectivity Costs to model provider billing and compute monthly connectivity spend from SNMP measurements, then using Traffic Costs to apply that cost context to flow-enriched traffic slices (e.g., ASN, customer, region, CDN/OTT, IP/CIDR) (Connectivity Costs KB, Introducing Traffic Costs).

What tools surface high-cost flows to control egress or connectivity spend?

Tools are most useful when they can attribute spend to specific traffic slices (customer, ASN, region, service) and reveal which routes or interconnects are driving the highest unit costs. Kentik supports this by calculating flow-based cost estimates for key slices of traffic and showing effective cost-per-Mbps plus the associated ingress/egress paths, making it easier to pinpoint high-cost paths and take action (Traffic Costs KB, Introducing Traffic Costs).

What tools can analyze cost per bit delivered across interconnects?

Cost-per-bit analysis requires normalizing billing models (95th percentile, flat-rate, tiered, commits) and translating them into comparable unit economics across transit, peering, IX, and private interconnect links. Kentik supports this by estimating Cost per Mbps in Connectivity Costs and by calculating effective cost per Mbps for traffic slices in Traffic Costs, enabling consistent comparisons across interconnect types and providers (Connectivity Costs KB, Peering & Interconnection).

What’s the best method for tracking interconnect and peering efficiency over time?

A practical method is to trend unit economics (cost per Mbps and total spend) alongside traffic mix so you can see which interconnects are getting more expensive, which are improving, and where traffic can be shifted to reduce cost without harming delivery outcomes. Kentik supports this by tracking monthly connectivity spend and cost-per-Mbps by provider and connectivity type, and by using edge workflows like Discover Peers to identify where transit traffic could be offloaded to peering at IXs and facilities (Connectivity Costs KB, Discover Peers KB).

How do I track dependency on specific transit providers over time?

Track both (1) how much traffic relies on each provider and (2) the unit cost and total spend associated with that provider, then trend those measures through routing changes, contract changes, and market shifts. Kentik supports this by breaking down estimated connectivity costs by provider and connectivity type, and by using Discover Peers (and related edge tooling) to show the ASes via which traffic gets to and from your network so provider reliance is measurable over time (Connectivity Costs KB, Discover Peers KB).

What tools help build peering proposals with data-driven insights?

Strong peering proposals are built on evidence: observed traffic volumes, where that traffic currently traverses transit vs peering, where there’s a shared footprint, and what the expected cost impact would be if traffic shifted. Kentik supports this by using Discover Peers to identify candidate peers and common IX/facility footprints, integrating PeeringDB details into workflows, and pairing that analysis with cost context so teams can quantify potential savings and build a credible business case (Peering & Interconnection, Discover Peers KB).

How do I right-size transit and IX capacity without overprovisioning?

Right-sizing is easier when you can see month-over-month spend trends, unit costs, and how close interfaces are to cost-driving thresholds in your billing model, then connect those signals to the specific traffic growth driving the change. Kentik supports this by automatically computing monthly connectivity spend from provider pricing models and SNMP traffic measurements, tracking cost-per-Mbps trends by provider and connectivity type, and using Traffic Costs to identify which traffic slices are pushing spend up or down (Connectivity Costs KB, Introducing Traffic Costs).

How do I quantify the financial impact of routing or peering changes?

Establish a baseline, make the routing/peering change, then compare before/after unit economics and total spend while controlling for traffic growth and mix changes so you can attribute impact to the decision. Kentik supports this by trending monthly connectivity cost and cost-per-Mbps in Connectivity Costs and by saving Traffic Costs snapshots (and automating monthly snapshots) to measure how specific traffic slices change in cost over time (Connectivity Costs KB, Introducing Traffic Costs).

What reports help finance and executives act on network spend?

Finance-friendly reporting typically includes cost trends, top cost drivers (providers, sites/markets, connectivity types), forecast vs actual, and “savings explained” tied to specific engineering actions. Kentik supports this by providing estimated cost and cost-per-Mbps rollups (plus invoice true-ups and billing error discovery) in Connectivity Costs, and by delivering traffic-slice cost views that help explain what’s driving spend and how changes affect margins (Connectivity Costs KB, StackPath case study).

Connectivity Costs

Real-time visibility into what you’re spending – and with whom.

- Upload contracts across all providers and connectivity (transit, peering, IX, PNI, etc.).

- Normalize complex billing models (95th percentile, flat-rate, tiered, and more).

- Track spending by provider, connectivity, site, and market.

- Validate invoices, uncover errors, forecast costs, and monitor trends.

Traffic Costs

Go deeper: See exactly what traffic is driving spending.

- Instantly calculate costs for key traffic slices – by CDN, OTT, ASN, AS group, region, city, customer, or IP/CIDR.

- Measure effective cost per Mbps.

- Identify high-cost routes and interconnects.

- Compare traffic costs against revenue to assess margin impact.

- Automate cost estimates with snapshots and trend tracking.

Platform

Solutions

- Reduce Cloud Spend

- Migrate To and From Any Cloud

- Improve Cloud Performance

- Optimize Enterprise WAN

- Network Performance Monitoring

- Deliver Exceptional Digital Experiences

- Detect and Mitigate DDoS

- Harden Network Policy Management

- Investigate Security Incidents

- Visualize All Cloud and Network Traffic

- Troubleshoot Any Network

- Understand Internet Performance

- Optimize Data Center Networks

- Consolidate Legacy Tools

- Optimize Peering and Transit

- Plan Network Capacity

- Reduce Network Spend

- Grow Subscriber Revenue